Few topics make the average American more uncomfortable than discussing money and finances. Despite the fact that everyone deals with the stress of financial decision making, talking about money remains taboo amongst most friends and family. Go ahead, bring up politics or criticize the local sports team, but don’t dare ask about salaries or investments.

Why is this the case? Perhaps it’s due to the emotional connection people have with money, or the lack thereof. Our financial well-being affects every aspect of our lives, so money naturally makes people emotional—especially when the potential of losing money enters the picture. That’s why managing the impact of emotions on financial decisions is crucial.

The Cost of Irrational Decision Making

Investing is all about skin in the game. Putting money into the market is a risk—there’s no guarantee an investment won’t lose money and leave the investors worse off than they started. Without risk, there would be no reward. But uncertainty can be scary, and the thought of losing money doesn’t just make people emotional—it makes them irrational.

Irrational decision making rears its ugly head during both boom and bust times. When stocks crash, investors are tempted to pull their money out because the emotional pain associated with the loss of capital is strong, even though most understand that stocks will eventually rebound. Likewise, investors are prone to getting too heavy into stocks when markets are rising and indices are setting new highs.

Acting irrationally can be costly. When investors panic sell during market crashes, they often remove their money at the lowest point. And on the other hand, investors experiencing a “fear of missing out” tend to buy in when markets are approaching a peak. Irrational decision making leads to selling low and buying high, which is the exact opposite of a sound investment plan.

Fear vs Greed

Behavioral finance is the study of consumers not as rational market participants, but as emotional human beings with worries, dreams, and feelings. Investors aren’t cold, calculating robots—they’re real people dealing with real-life situations.

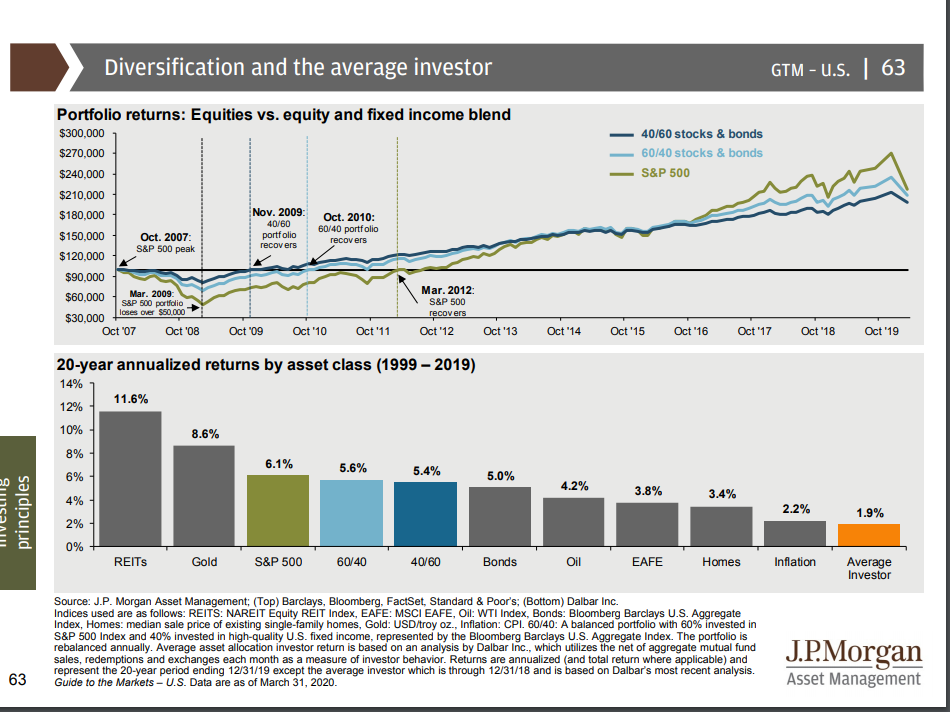

The two emotions most involved with investing are fear and greed. Fear strikes when markets tumble and investors become afraid of losing more money. Greed occurs when markets are high and investors seek to squeeze out a few extra percentage points of gains. However, markets are fickle creatures, and when investors get greedy, smart money often gets fearful. Take a look at the returns of a 60/40 and 40/60 portfolio against the S&P 500 since late 2007:

In 2007, the stock market was soaring and investors in a 60/40 portfolio looked like they were missing out. However, when the market turned, so did the fortunes of the diversified portfolios. The S&P 500 peaked in October of 2007 and investors in the diversified portfolios saw outperformance for the next 7 years, even after the index recovered in March 2012. In the last 20 years, the average investor has failed to even keep up with inflation due to irrational decision making, while those who stick to a financial plan far outpace them.

Cycle of Market Emotions

Participants often go through stages of emotions during market cycles. It starts with optimism and excitement over an investment, followed by euphoria. Once euphoria sets in, investors should see warning lights—this is the point of maximum risk. Euphoria often leads to complacency and anxiety as the market flattens or begins to trend down. Anxiety turns to fear and fear turns to panic as the bear market sets in and investors head for the exits.

Eventually, market participants reach a stage of despondency as the bear market lengthens and stocks reach their lows. This period of despondency is actually the next turning point—the point of maximum opportunity. As prices settle and begin to swing back up, optimism overtakes despondency and the cycle begins to repeat. Knowing where you are in this cycle is key to avoiding irrational actions.

Utilize Bucketing Across Your Time Horizon

An approach called “bucketing” can help take some of the emotional decisions out of your hands. Advisors often recommended clients break up their assets into multiple “buckets”. These buckets often include illiquid assets for high-risk investments and liquid assets for less risky vehicles. Cash in the safer bucket could easily be withdrawn if needed, while the funds in the risky bucket can be tied up for longer.

By using different asset buckets, investors can keep the emotions on the sideline and act only when one of their buckets moves out of sync with the rest. If stocks rise significantly, the risky bucket might take up a larger percentage of the total portfolio than is ideal. In this case, the investor would sell stocks in the risky bucket and buy more assets for the safer bucket to bring the system back into equilibrium.

The Value of Working With a CFP® Professional

Investing is difficult enough for the pros, but it’s hard to control emotions when prices are gyrating and the fear of missing out ramps up. Certified Financial Planner™practitioners help create long-term investment plans, but more importantly, they guide clients on how to stick with those plans when the market moves suddenly.

A CFP® knows that even the most prudent investors are prone to bouts of irrationality. Having an outside voice guide your decision making will eliminate the emotional, short-term thinking that trips up so many great potential investments. If short-term irrationality can be kept at bay, long-term investment strategies will work more efficiently. Speak with Josh Strange, a CERTIFIED FINANCIAL PLANNER™ practitioner at Good Life Financial Advisors of NOVA for assistance.

Disclosure

The Standard & Poor’s 500 Index is a capitalization weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. The S&P 500 is an unmanaged index which cannot be invested into directly. Past performance is no guarantee of future results.